The first step of Financial Freedom starts with smart budgeting. The household budget is one of the major challenges for every family. We all know that budgeting is a boring task but if someone wants to enjoy financial freedom budgeting should be their first priority. Making a balance between expenses and saving is the key to lead a healthy financial life.

Importance of Budgeting in Personal Finance:

The Smart Monthly budgeting is a powerful personal finance tool to manage your monthly spending. It allows you to take financial decisions well ahead of time, which makes it easier to manage all your expenses along with paying off debts and saving for the future.

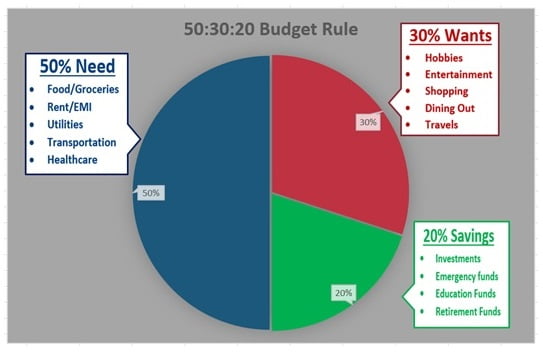

In today’s inflated Lifestyle irregular spending and less saving patterns could lead to less than anticipated standard of living in the future especially after retirement. If you are struggling to manage your finances and want to keep them in line with your long term financial goals, then there is a thumb rule called the “50/30/20 Rule” of budgeting which you should follow.

What is Budget Method 50:30:20?

U.S. Senator Elizabeth Warren has stated the ’50/20/30 budget rule’ in her book, All Your Worth: The Ultimate Lifetime Money Plan published in 2005. The rule says that your after-tax income can be divided into three parts, 50 percent on Basic needs; 30 percent on Wants or Luxuries; And 20 percent on savings/financial security.

Needs (50%):

Needs are expenses that you require for your survival, these include things like foods and groceries, house rent or EMI, Utility bill payments, health care transportation, basic clothing, and supplies for living. These are your must-have necessities.

The Needs category does not include luxuries such as subscriptions of Hotstar, Netflix, Gym membership, shopping, Gadgets, etc.

Want (30%):

Wants are expenses on Luxury. This category includes expenses like Shopping, hobbies, dining out, entertainment, cable TV, internet, vacations, gym memberships, subscriptions, and other luxuries.

Expenses on luxury may be optional. That means they can also be avoided. Since these expenses are not necessities to live your life you should refrain from excess Credit card expenses and pay later digital loans and no-cost EMIs. According to the rule of Budget 50:30:20, if you end up spending more on luxuries then you are only left with the option of lowering down your savings and need allocations.

Savings (20%):

This category Suggests that 20 % of your income should be saved and it should be invested for financial goals. You can use this money to invest in mutual funds, stocks, Bank RD, and provident funds for wealth creation, emergency fund, retirement, etc. In any situation, you must ensure 20% of your income towards savings for any unfortunate events in life.

Conclusion:

Overall the budgeting rule 50:30:20 is a perfect option for those who are starting their carrier. But it doesn’t work well for the higher-income class, in those cases, it can be used as 50% Need, 30% Savings, and 20% on Luxuries. You can increase and decrease your allocation as per your income and Suitability. For higher-income class, it is best to consult any inform Financial Advisor and plan according to their Income and requirements.

Happy Investing!!

One Comment on “Smart Budgeting 50:30:20 Rule”

Comments are closed.