What is Retirement Planning?

Retirement planning is the process of generating a corpus that can support the financial requirements to maintain your current lifestyle after you stop working. Just like you need money today to pursue a decent lifestyle, you also require money to maintain a comfortable life after your retirement.

When it comes to time, investment and planning, we tend to place retirement planning last on our priority list. At a young age when we start earning, retirement planning might not be an interesting way to spend time. But if one gives it a thought, that’s worth it.

Need of retirement planning

Securing your finances well before retirement can help you in:

- Regular monthly income for your day-to-day living expenses to maintain your current lifestyle.

- Fulfilling your dreams and aspirations you put off for later

- The increase in average life expectancy due to better healthcare and progress in science

- To overcome increasing prices of goods and services due to inflation.

- Healthcare costs are rising at an astonishing rate of over 10% p.a. Hence, growing older means more will be your healthcare expenses.

- Now more families are shifting from joint family to nuclear family therefore, reducing the dependence on kids is not possible without proper retirement planning.

- Leave a legacy for future generations.

How To Plan Through Mutual Funds?

Retirement planning can be divided into two steps, the first one is the accumulation phase which is pre-retirement and another one is the distribution phase post-retirement phase.

Step 1. Accumulation Phase:

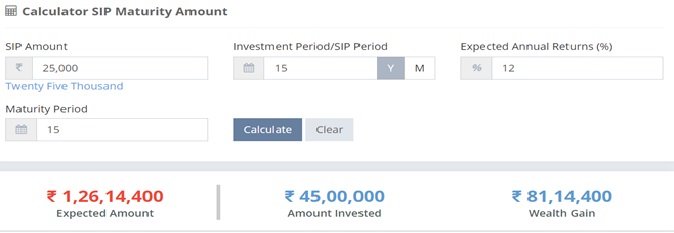

If a person invests 25000/- Monthly into Equity Mutual Fund through SIP for 15 years and the assumed return of the fund is12% then he will have approx 1.25 cr at the end of 15 years.

Step 2. Distribution Phase:

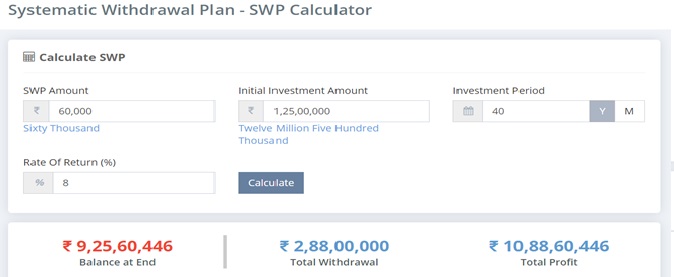

Now in this step just invest the above corpus generated through SIP into hybrid schemes and start a Systematic Withdrawal Plan (SWP) from it, where you will receive a fixed monthly payout along with capital appreciation in the longer term.

Monthly withdrawal amount 60,000/- from the age of 60 to 100 (40yrs). Post-retirement return @ 8%, balance amount at the age of 100 yrs 9.25cr. in the future, you can increase the monthly withdrawal amount as well.

Happy Investing!!!!